[ad_1]

Getting Comfy Managing Your Cash

Getting Comfy Managing Your Cash

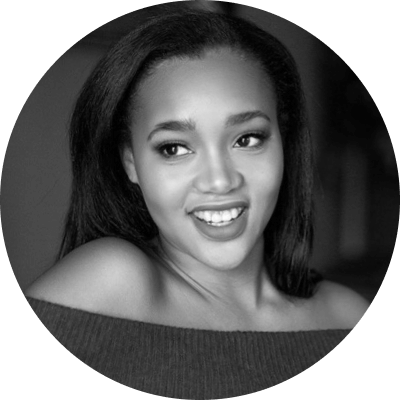

At twenty-two years outdated, Lauren Simmons turned the youngest girl and second African American girl to

commerce on the ground of the New York Inventory Change. However Simmons isn’t motivated by making historical past. She desires to

educate folks on the significance of economic wellness. She desires the trade to be a extra consultant place.

And: “I wish to make finance attractive,” says the previous equities dealer turned entrepreneur. “If I can empower one

individual, I’ve carried out my job. However my aim is to empower extra.”

For many of her life, Simmons, wasn’t desirous about finance in any respect. She had grand plans to develop into an

epigeneticist. However finance selected her, she says. When she arrived in New York Metropolis after faculty, she took conferences

with “anybody and everybody.” Richard Rosenblatt of Rosenblatt Securities gave her a shot, and her world flipped upside

down. “After I used to be employed, I keep in mind listening to Richard say, ‘This girl had the audacity to return to Wall Road and

apply for a job she knew nothing about!’” Simmons laughs. “However on the finish of the day, I feel he admired that.”

“Did they respect me? Sure. Did they take me significantly as an worker? Completely not. However I thrived on

that doubt—and I stood my floor from day one.”

With a heat smile, a pointy wit, and a powerful aversion to pantsuits, Simmons didn’t match the mildew—she broke it. And

she knew she needed to work more durable than most to show herself, whereas her male coworkers took bets on whether or not or not

she’d go the Sequence 19 (a requisite examination with an 80 p.c fail charge). “It was about as boys’ membership because it will get,”

says Simmons. “Did they respect me? Sure. Did they take me significantly as an worker? Completely not. However I thrived on

that doubt—and I stood my floor from day one.”

Simmons is aware of that extra is required to vary the tradition of the trade. However she’s hopeful. She’s bought a TV present,

talking engagements, and a film deal underway. All tasks that she hopes will encourage extra younger minds to get

curious.

Pondering again to when she penned her title alongside the Rockefellers and Vanderbilts within the NYSE induction e book,

Simmons feels conflicted. “It was bittersweet,” she says. “It’s loopy how in two-thousand-anything, we’re nonetheless

making historical past with the primary Black president and the primary African American feminine VP—that we’re nonetheless marking

these historic achievements.”

In our dialog, Simmons lined all the things from effecting change to overcoming imposter syndrome to

coping with doubters to why we shouldn’t worry the market or the B phrase (ahem, budgeting).

A Q&A with Lauren Simmons

Twenty-seventeen, the yr that my story went viral, was the yr of the lady. We had the Ladies’s March after Trump’s inauguration and due to that, we now have probably the most girls we’ve ever had sitting in Congress. Final yr, we had the Black Lives Matter motion gaining momentum, and we’re about to have probably the most various Congress in historical past. So there are particular pockets in America which can be actively altering. However there are different elements, just like the finance sector, that aren’t. And I’m bored with having conversations about what the motion steps are. For me, it’s not about what are we going to do; it’s about doing it. I’ve seen males are available on Wall Road with no expertise who landed the job—and I used to be that lady, too, in spite of everything. But when it had been a precedence to get extra variety in—girls, LGBTQ+, folks of coloration—it might occur.

As girls, we’re so fast to downplay our achievements. We’ve a tough time taking possession of our successes. So primary, it’s about stopping the damaging self-talk. And quantity two, it’s about surrounding your self with supportive individuals who will rally round you and level out your greatness. It’s okay to indulge in your achievements—that doesn’t make you too proud or too big-headed. Males do it on a regular basis.

Being answerable for your cash is being answerable for your basis. Being answerable for your basis is being answerable for your future. Even when you’re married, you shouldn’t must rely solely in your associate to make fiscal choices. You will be simply as subtle as they’re. And we want extra position fashions to open up the dialogue and preserve these conversations going—particularly with youthful generations, in order that they, too, can really feel included.

Individuals usually ask me, What ought to I put money into? And I inform them: In case you don’t have a financial savings account, we shouldn’t be speaking. Bank card debt can be an enormous no-no. You shouldn’t produce other liabilities that you’re stressing over earlier than you make investments. And also you wish to have an emergency fund arrange, which feels extra related now than ever. However I additionally need folks to have enjoyable. You don’t must be the frugal coupon girl, however you don’t must sustain with the Kardashians both—I don’t even know in the event that they’re nice with their cash. It’s about hanging a wholesome steadiness.

Fifty p.c of your revenue ought to go to on a regular basis bills, 30 p.c ought to go towards your financial savings, and 20 p.c ought to go towards the long run—not less than. That’s the fundamental tenet of budgeting. I’m not frugal by any means, however I save 80 p.c of my revenue. Once I began out on the New York Inventory Change, folks thought I used to be killing it, however I used to be making solely $23,000 a yr, and that’s not sufficient to breathe in New York Metropolis. As soon as I left, I began making considerably extra money, however even then, I used to be saving 80 p.c. I do know that’s loopy, and I used to be residing with my grandparents on the time who didn’t ask me for hire, however I’ve all the time been very strategic about it. You may have enjoyable and take journeys and spoil your self in your birthday. But it surely’s essential to have a funds.

They are saying you possibly can break a behavior in twenty-one days. Even when it takes three months, that’s one thing that may follow you long-term. Your way of life relies in your mindset. In case your mindset isn’t there, then you definately’re all the time going to have hassle saving. And if you can begin budgeting throughout a pandemic, then you are able to do it any time. Make it your new affirmation: I’m a great budgeter!

That is borrowed from Warren Buffett: Don’t worry the market. When you have a fear-based mindset, then you definately shouldn’t be investing. You need to be placing your cash in and strolling away—not checking it every day. When you have solely 5 {dollars} to your title, don’t make investments all 5 {dollars}. No matter you place in, examine on it each couple of months. However don’t get too frazzled about what’s occurring to it, as a result of you’ll by no means win the sport that method.

Additionally, be conscious of ESG (environmental social governance) investing. Persons are actually beginning to take a look at: How is that this firm operating? Is it giving again to its neighborhood? Is it making a constructive influence on the surroundings? Does it have a great model ethos and tradition in relation to variety and inclusion? These are going to be key elements in figuring out what firms you need to be taking note of.

We’ve already seen modifications up to now yr round how folks make investments, and know-how is placing folks on the identical taking part in discipline. There are platforms that may allow you to put down a zero greenback minimal with zero charges and nil curiosity. However I need folks to coach themselves on the businesses they’re contemplating investing by means of. Do your analysis. There are some nice instruments on the market, and there are some not nice instruments on the market. Search for respected firms that may have the ability to safe your funds in case something had been to occur. Acorns is fabulous, NerdWallet is nice for retaining observe of your spending habits, and what Sallie Krawcheck is doing at Ellevest is superb—they’ve a special enterprise mannequin that does require a minimal greenback down with charges. However there are additionally different nice firms which have been round for a very long time, like TD Ameritrade, that give unbelievable tutorials on investing together with analysis on shares.

Something you place your time and power into, you’ll get one thing out of. Throughout my first three months on the ground, I might hearken to CNBC’s podcast and have Bloomberg on within the background for 2 hours a day. I might document them, hearken to them, and return and Google something I didn’t perceive. In case you commit a couple of months to understanding how cash strikes, you can be properly outfitted to make good choices in relation to investing. No, you’re not going to be an professional, however not less than you’ll have the ability to make educated decisions.

The illustration that’s on the market on Wall Road and on TV is predominately White males. I’m attempting to create an inclusive place the place everybody can perceive it. I’m internet hosting the inaugural season of Going Public, a brand new present that permits on a regular basis Individuals to put money into IPOs whereas they watch, and I’m creating my very own TV collection along with a biopic movie popping out with AGC Studios produced by Kiersey Clemons. However there’s nonetheless so much I wish to accomplish. Each time a chance involves me, I’m going with my instinct. If it feels proper, I say sure. It’s been true all through my total profession. I knew nothing about finance after I first began out, however I believed, Let’s strive it. I take pleasure in being the dumbest individual within the room as a result of there’s a lot alternative for development there. And if it doesn’t work out, it doesn’t work out. However not less than I can say that I attempted.

Lauren Simmons is a former equities dealer and history-maker turned TV host, producer, and entrepreneur who has made it her mission to assist folks take management of their monetary well being. At twenty-two years outdated, she turned the youngest girl and the second African American girl to commerce on the ground of the New York Inventory Change in its 200-plus-year historical past. Her achievements have landed her on Harper’s Bazaar’s Ladies Who Dare record, Ebony’s Energy 100, and Politico’s Ladies of Affect.